Ask Wall Street what’s ahead for stocks to the end of 2024 after Friday’s strong jobs report, and you mostly get a thumbs up.

But interest rate increases, especially for mortgage rates, may keep things in check.

Don’t miss the move: Subscribe to TheStreet’s free daily newsletter

Stocks were higher, partly because Fed governor Adrianne Kugler said the central should continue to focus on beating down inflation. Still, she said the Fed needs to maintain a “balanced approach” that avoids slowing job and economic growth.

Still, the bull case for stocks seems a little squishy. There are headwinds facing markets that could make stocks range-bound through the end of the year, Brian Weinstein, head of global markets at Morgan Stanley.

These include:

- Higher interest rates, particularly rates on mortgages.

- Important readings on inflation later this week.

- The economic fallout from Hurricane Milton’s assault on Florida after the havoc of Hurricane Helene.

- The election.

- The potential for widening war in the Middle East.

Jobs data paints a bullish picture

The jobs report was undeniably bullish. This is not only because it suggested that payroll employment jumped by 254,000 and unemployment fell slightly to 4.1% but also because the Bureau of Labor Statistics revised estimates for job growth in August and July up by 72,000, more than expected.

Veteran analyst spotlights huge bond market signal

Big bets in the bond markets are telling investors something important.

Stocks surged on Friday on the report. But the S&P 500 and other major indexes fell back on Monday because of worries that the jobs report suggested the Federal Reserve’s decision to cut its key interest rate by a half-percentage point was too big.

On Tuesday, traders seemed more bullish on stocks, with the Standard & Poor’s 500 Index up nearly 1% and the Nasdaq Composite up 1.45%. The Dow Jones Industrial Average added 0.3%.

The S&P 500 and Nasdaq were higher because of gains in technology stocks. The S&P 500 Technology Sector was up about 2%, led by strong gains in Palantir Technologies (PLTR) , up 6.6%; Palo Alto Networks (PANW) , up 5.1%, and Nvidia (NVDA) , up 4.1%.

The Technology Select Sector ETF (XLK) added 1.9%. It’s up 15.2% since an Aug. 5 bottom of $197.90.

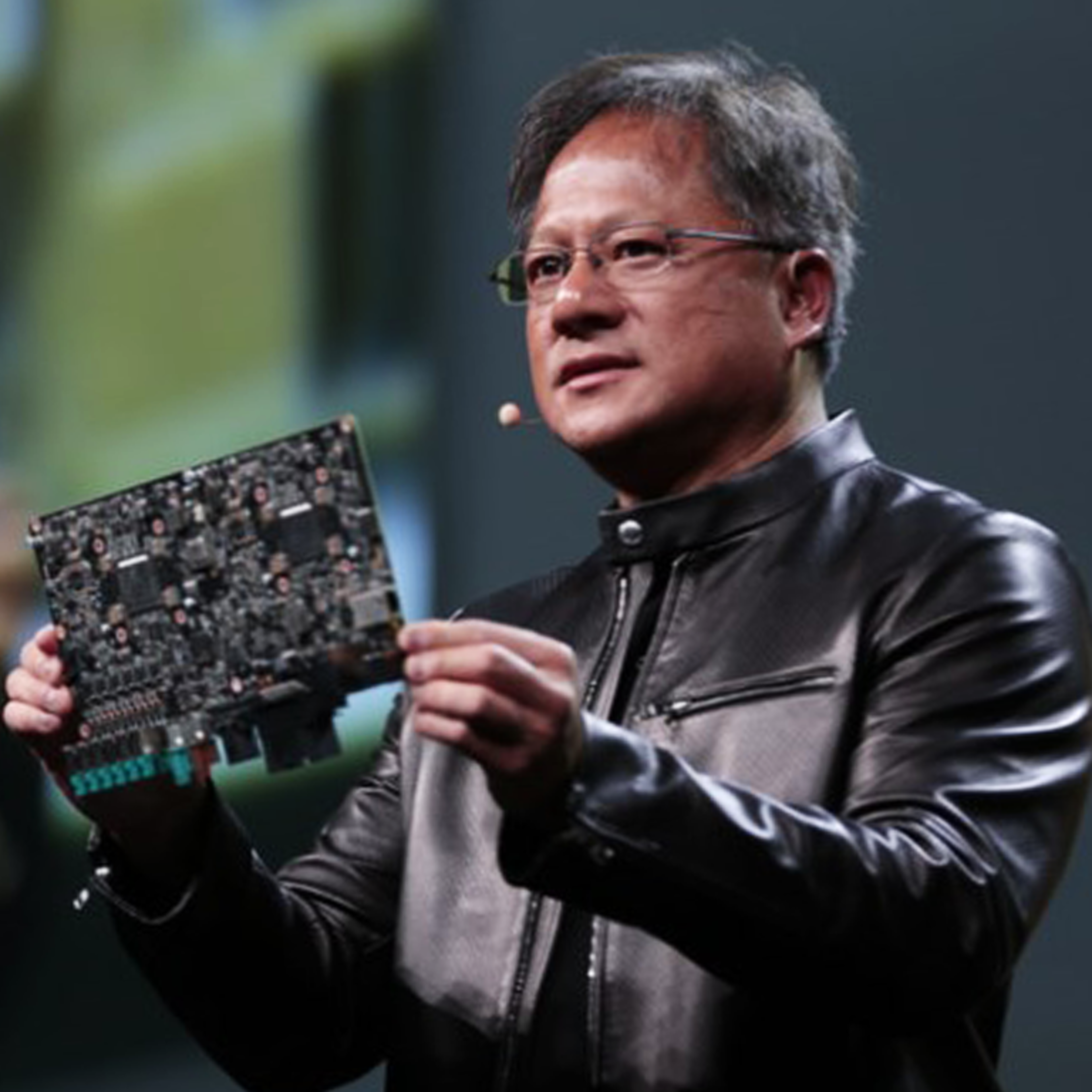

Nvidia fuels bulls’ excitement

Nvidia is up more than 29% since Sept. 6, in part in reaction to CEO Jensen Huang’s comment that demand for its new Blackwell graphics processing unit is “insane.”

The product is designed to address the computing and bandwidth needs of current and future artificial intelligence workloads.

Microsoft (MSFT) was up 1.3% to $414.71, despite a downgrade to “perform” from outperform” from brokerage Oppenheimer.

The firm believes consensus estimates for revenue and earnings per share are too high. The issue: losses from Microsoft’s involvement in OpenAI, which could be in the $2 billion-to-$3 billion range in fiscal 2025, which began on July 1.

Was the Fed’s rate cut too much too soon?

There was a counter view: that the Fed’s rate decision—which trimmed the federal funds rate from 5.25%-to-5.5% to 4.75%-to-5%—was too big and could prove to be inflationary.

That worry has pushed interest rates higher. The 10-year Treasury yield rose to 4.02% on Tuesday from 3.62% on September 16, two days before the Fed’s decision.

More Wall Street Analysts:

- Analysts revise Corning stock price targets after investor meeting

- Analysts retool Carnival stock price targets ahead of earnings

- Analyst revisits Costco stock price target, rating ahead of earnings

The rate on a 30-year mortgage was quoted Tuesday at 6.62% at Mortgage News Daily, up from 6.11% on Sept. 11. The boost would push the monthly principal-and-interest portion of monthly payment from $1,516 to $1,599, a 5.5% increase.

The 10 best investing books (according to stock market pros)

Explore an expert-curated list of the best books on investing handpicked by TheStreet Pro’s star-studded suite of Wall Street professionals.

About the author

Charley Blaine

Senior Editor