Utilities Select Sector SPDR ETF

Find Ratings Reports- Last Ratings Update:02/29/2024

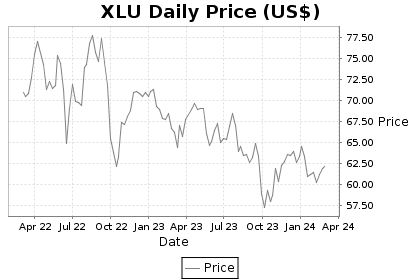

- Price as of 02/29/2024 :$62.10

- Net Assets:$0 Million

- NAV:$61.71

- Premium0.63%

- Peer Rank:7 of 20

- Investment Rating:C-

- Performance:C-

- RiskC+

We rate Utilities Select Sector SPDR at C-. Positive factors that influence this rating include a greater than above average total return, low price volatility, low expense structure and long term portfolio management tenure. The fund invests approximately 100% of its assets in stocks and may be considered for investors seeking a Sector - Utilities strategy.

Total return ranks above peers over the last three years. The Utilities Select Sector SPDR has returned an annual rate of 6.29% since inception. More recently, the fund has generated a total return of 3.96% in the last five years, 4.31% in the last three years, and -3.65% in the last year. How does that compare to other equity funds? In the last five years, it has outperformed 42% of them. It has also outpaced 57% of its competitors on a three year basis and 10% of them over the last year for the period ending 2/29/2024. On a year to date basis, XLU has returned -2.54%.

Downside risk has been below average. XLU has a draw down risk of -20.86%, which is the largest price decline experienced over the last three years. This fund has a three year standard deviation of 18.0%. This fund has experienced a high level of volatility in its monthly performance over the last 36 months.

Low expense ratio helps performance. As XLU is an exchange traded fund, it has no front end or back end load.

The Utilities Select Sector SPDR is managed by Karl A. Schneider at SSgA Funds Management Inc. This fund is one of 128 SSgA Funds Management Inc exchange-traded funds launched since 1/22/1993 that we track.