Nuveen NASDAQ 100 Dynamic Overwrite Fund

Find Ratings Reports- Last Ratings Update:02/29/2024

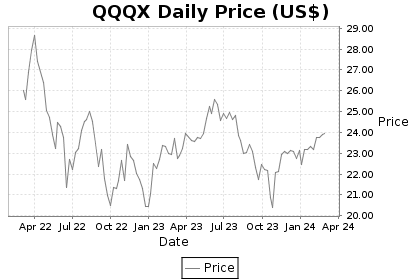

- Price as of 02/29/2024 :$23.94

- Net Assets:$1,204.83 Million

- NAV:$26.38

- Premium-9.25%

- Peer Rank:291 of 397

- Investment Rating:C

- Performance:C

- RiskC+

We rate Nuveen Nasdaq 100 Dynamic Overwrite at C. Positive factors that influence this rating include a greater than above average total return, low price volatility and low expense structure. The fund invests approximately 100% of its assets in stocks and may be considered for investors seeking an Equity Income strategy.

Total return ranks above peers over the last three years. The Nuveen Nasdaq 100 Dynamic Overwrite has returned an annual rate of 9.88% since inception. More recently, the fund has generated a total return of 9.47% in the last five years, 4.54% in the last three years, and 9.67% in the last year. How does that compare to other equity funds? In the last five years, it has outperformed 71% of them. It has also outpaced 58% of its competitors on a three year basis and 48% of them over the last year for the period ending 2/29/2024. On a year to date basis, QQQX has returned 4.58%.

Downside risk has been below average. QQQX has a draw down risk of -33.34%, which is the largest price decline experienced over the last three years. This fund has a three year standard deviation of 22.2%. This fund has experienced a high level of volatility in its monthly performance over the last 36 months.

High expense ratio hinders performance. On total assets of $1.20 billion, QQQX maintains a high expense ratio compared to its Equity Income peers of 0.92% to cover all operating costs. Brokerage costs for the fund to buy and sell shares are not included in the expense ratio. As QQQX is a closed end fund, it has no front end or back end load.

Manager tenure is a net positive but performance record lags managerial peers. Substandard fund managers tend to be replaced, so a long tenure is usually a good sign that a fund is achieving its objectives. The Nuveen Nasdaq 100 Dynamic Overwrite has been managed by David A. Friar for the last 13 years. Over that period, the manager was able to capture more actual gains in excess of the expected return than just 22% of other fund managers.