BlackRock Energy and Resources Trust

Find Ratings Reports- Last Ratings Update:02/29/2024

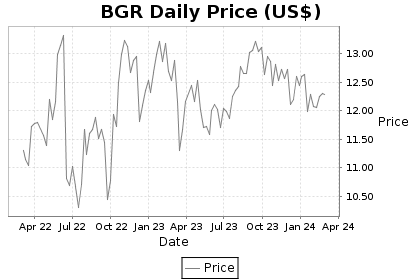

- Price as of 02/29/2024 :$12.29

- Net Assets:$398.49 Million

- NAV:$14.38

- Premium-14.53%

- Peer Rank:24 of 95

- Investment Rating:A+

- Performance:B

- RiskB

We rate BlackRock Energy & Resources at A+. Positive factors that influence this rating include a well above average total return and low expense structure. The fund invests approximately 100% of its assets in stocks and may be considered for investors seeking a Sector - Energy/Natural Res strategy.

Total return ranks very high in comparison with peers over the last three years. The BlackRock Energy & Resources has returned an annual rate of 4.38% since inception. More recently, the fund has generated a total return of 8.71% in the last five years, 17.07% in the last three years, and 4.34% in the last year. How does that compare to other equity funds? In the last five years, it has outperformed 67% of them. It has also outpaced 96% of its competitors on a three year basis and 25% of them over the last year for the period ending 2/29/2024. On a year to date basis, BGR has returned 1.40%.

Downside risk has been below average. BGR has a draw down risk of -16.89%, which is the largest price decline experienced over the last three years. This fund has a three year standard deviation of 24.3%. This fund has experienced a high level of volatility in its monthly performance over the last 36 months.

High expense ratio hinders performance. On total assets of $398.49 million, BGR maintains a high expense ratio compared to its Sector - Energy/Natural Res peers of 1.04% to cover all operating costs. Brokerage costs for the fund to buy and sell shares are not included in the expense ratio. As BGR is a closed end fund, it has no front end or back end load.

Manager tenure is a net positive but performance record lags managerial peers. Substandard fund managers tend to be replaced, so a long tenure is usually a good sign that a fund is achieving its objectives. The BlackRock Energy & Resources has been managed by Christopher M. Accettella for the last 12 years. Over that period, the manager was able to capture more actual gains in excess of the expected return than just 47% of other fund managers.