iShares Silver Trust

Find Ratings Reports

SLV : ARCA :

$24.9

-0.09 |

-0.360144%

-0.09 |

-0.360144%

-0.09 |

-0.360144%

-0.09 |

-0.360144%

Today's Range:

24.78 -

25.05

Avg. Daily Volume:

0

04/24/24 - 9:22 PM ET

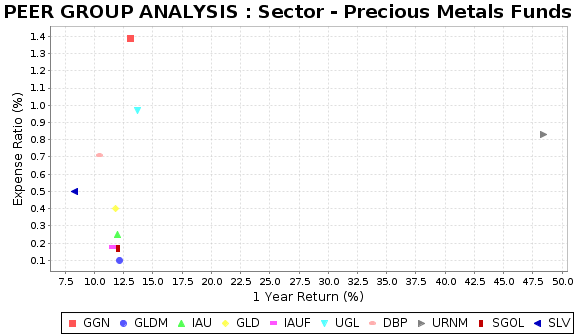

This chart compares SLV to the highest rated funds in its peer group of Sector - Precious Metals funds. The above graph illustrates two key measures that investors should consider when assessing the investment potential of a particular fund. One of the key factors is how the fund has performed over the most recent reporting period, defined as the 1 year total return on the bottom axis. The second factor is the fund's reported expense ratio, on the right axis, which includes things like management fees. The best funds, with higher returns and lower expenses, stake out a position in the lower left part of this graph.

TOP RATED FUNDS : Sector - Precious Metals | ||||||

|---|---|---|---|---|---|---|

| Name | Ticker | Return YTD | 1 Year Return |

3 Year Return | Expense Ratio | Peer Rank |

| GAMCO Global Gold Nat ResandIncome | GGN | 0.82 | 13.11 | 13.89 | 1.39 | 1 |

| SPDR Gold MiniShares | GLDM | 0.95 | 12.14 | 6.93 | 0.10 | 2 |

| iShares Gold Trust | IAU | 0.95 | 11.96 | 6.78 | 0.25 | 3 |

| SPDR Gold Shares | GLD | 0.90 | 11.83 | 6.62 | 0.40 | 4 |

| iShares Gold Strategy | IAUF | 1.02 | 11.53 | 6.25 | 0.18 | 5 |

| ProShares Ultra Gold | UGL | 0.25 | 13.69 | 6.22 | 0.97 | 6 |

| Invesco DB Precious Metals Fund | DBP | 0.27 | 10.40 | 3.40 | 0.71 | 7 |

| Sprott Uranium Miners | URNM | 1.80 | 48.41 | 26.69 | 0.83 | 8 |

| abrdn Physical Gold Shares | SGOL | 0.86 | 12.04 | 6.87 | 0.17 | 9 |

| iShares Silver Trust | SLV | -2.80 | 8.29 | -3.23 | 0.50 | 23 |

| The above table compares the total return performance and expense ratio of iShares Silver Trust to the top rated funds within the Sector - Precious Metals peer group. iShares Silver Trust ranks number 23 out of 32 Sector - Precious Metals closed-end and exchange-traded funds that we rate. | ||||||