First Trust US Equity Opportunities ETF

Find Ratings Reports -0.1421 |

-0.142983%

-0.1421 |

-0.142983%

- Last Ratings Update:02/29/2024

- Price as of 02/29/2024 :$102.65

- Net Assets:$0 Million

- NAV:$103.9

- Premium-1.2%

- Peer Rank:460 of 559

- Investment Rating:D

- Performance:C-

- RiskC

We rate First Trust US Equity Opportunities at D. Negative factors that influence this rating include a high price volatility. The fund invests approximately 100% of its assets in stocks and may be considered for investors seeking a Growth - Domestic strategy.

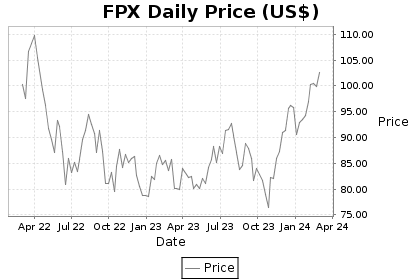

Total return ranks well below peers over the last three years. The First Trust US Equity Opportunities has returned an annual rate of 10.39% since inception. More recently, the fund has generated a total return of 8.42% in the last five years, -4.16% in the last three years, and 21.46% in the last year. How does that compare to other equity funds? In the last five years, it has outperformed 65% of them. It has also outpaced 16% of its competitors on a three year basis and 81% of them over the last year for the period ending 2/29/2024. On a year to date basis, FPX has returned 8.35%.

Downside risk has been above average. FPX has a draw down risk of -41.19%, which is the largest price decline experienced over the last three years. This fund has a three year standard deviation of 24.5%. This fund has experienced a high level of volatility in its monthly performance over the last 36 months.

High expense ratio hinders performance. As FPX is an exchange traded fund, it has no front end or back end load.

The First Trust US Equity Opportunities is managed by David G. McGarel at First Trust Advisors LP. This fund is one of 195 First Trust Advisors LP exchange-traded funds launched since 8/19/2003 that we track.