First Trust New Opportunities MLP & Energy Fund of Beneficial Interest

Find Ratings Reports- Last Ratings Update:02/29/2024

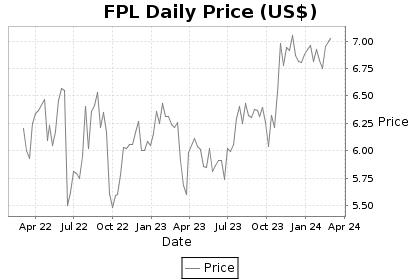

- Price as of 02/29/2024 :$7.02

- Net Assets:$169.65 Million

- NAV:$7.48

- Premium-6.15%

- Peer Rank:3 of 95

- Investment Rating:A+

- Performance:A

- RiskB

We rate First Trust New Opptys MLP & Energy at A+. This overall rating indicates it is among the top 10% of all closed end funds in its peer group. Positive factors that influence this rating include a well above average total return and low price volatility. The fund may be considered for investors seeking a Sector - Energy/Natural Res strategy.

Total return ranks very high in comparison with peers over the last three years. The First Trust New Opptys MLP & Energy has returned an annual rate of -3.23% since inception. More recently, the fund has generated a total return of 4.45% in the last five years, 21.18% in the last three years, and 23.37% in the last year. How does that compare to other equity funds? In the last five years, it has outperformed 45% of them. It has also outpaced 98% of its competitors on a three year basis and 84% of them over the last year for the period ending 2/29/2024. On a year to date basis, FPL has returned 6.50%.

Downside risk has been below average. FPL has a draw down risk of -15.04%, which is the largest price decline experienced over the last three years. This fund has a three year standard deviation of 20.3%. This fund has experienced a high level of volatility in its monthly performance over the last 36 months.

High expense ratio hinders performance. On total assets of $169.65 million, FPL maintains a high expense ratio compared to its Sector - Energy/Natural Res peers of 2.69% to cover all operating costs. Brokerage costs for the fund to buy and sell shares are not included in the expense ratio. As FPL is a closed end fund, it has no front end or back end load.